Life Insurance in and around Centennial

State Farm can help insure you and your loved ones

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

Purchasing life insurance coverage can be a lot to consider with many different options out there, but with State Farm, you can be sure to receive empathetic reliable service. State Farm understands that your end goal is to protect your family.

State Farm can help insure you and your loved ones

Don't delay your search for Life insurance

State Farm Can Help You Rest Easy

When it comes to deciding on how much coverage is right for you, State Farm can help. Agent Scott Underwood can assist you as you take a look at all the factors that go into the type and amount of insurance you need. These components may include your current age, your physical health, and sometimes even body weight. By being aware of these elements, your agent can help make sure that you get a suitable policy for you and your loved ones based on your individual situation and needs.

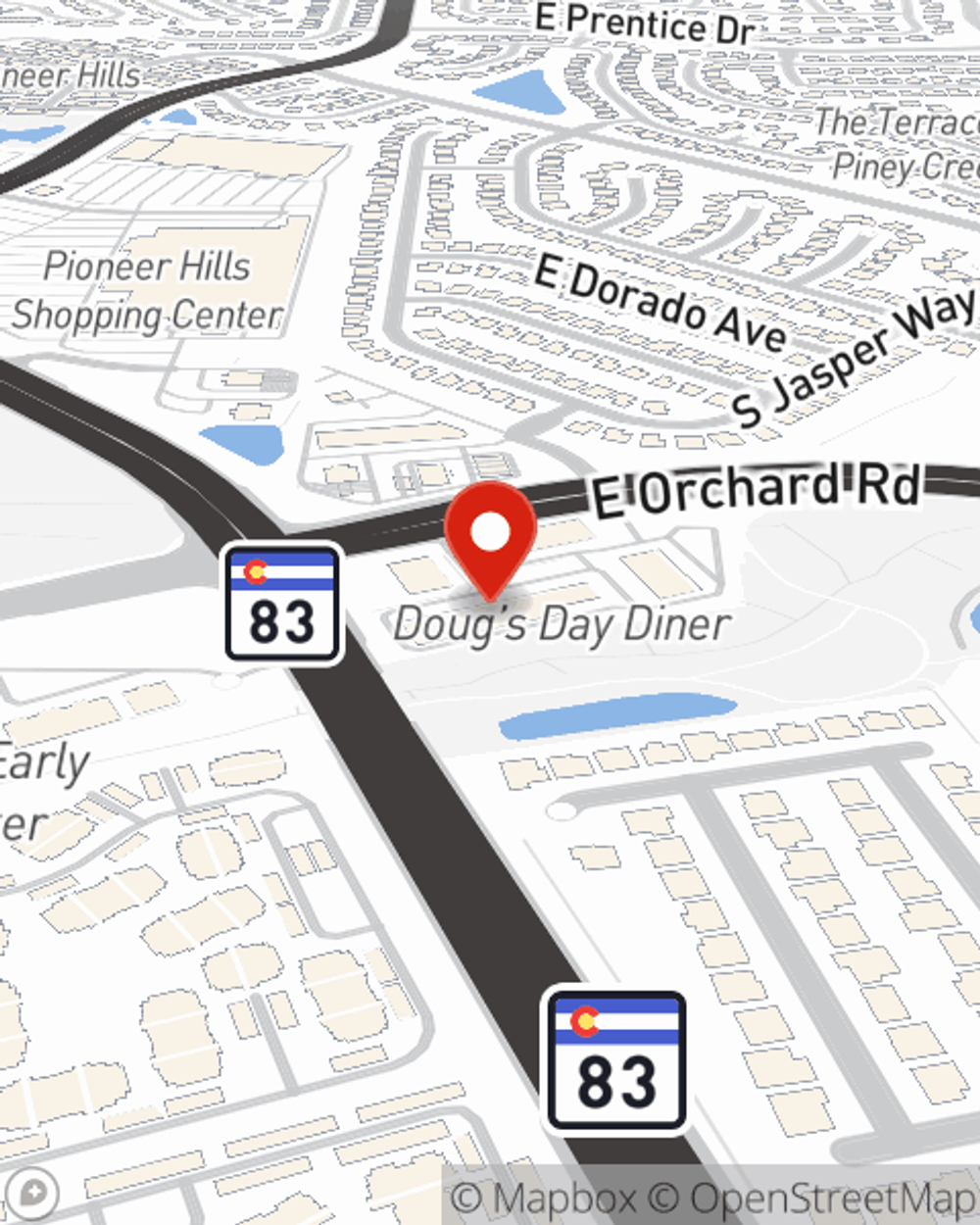

Call or email State Farm Agent Scott Underwood today to find out how a State Farm policy can ease your worries about the future here in Centennial, CO.

Have More Questions About Life Insurance?

Call Scott at (303) 699-2288 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Estate planning: Understanding the basics

Estate planning: Understanding the basics

An estate plan does more than just offer direction for assets. Estate planning can help others execute your wishes and take care of those you love.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Scott Underwood

State Farm® Insurance AgentSimple Insights®

Estate planning: Understanding the basics

Estate planning: Understanding the basics

An estate plan does more than just offer direction for assets. Estate planning can help others execute your wishes and take care of those you love.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.